Pivot Points

Posted: Tue Aug 09, 2022 7:58 am

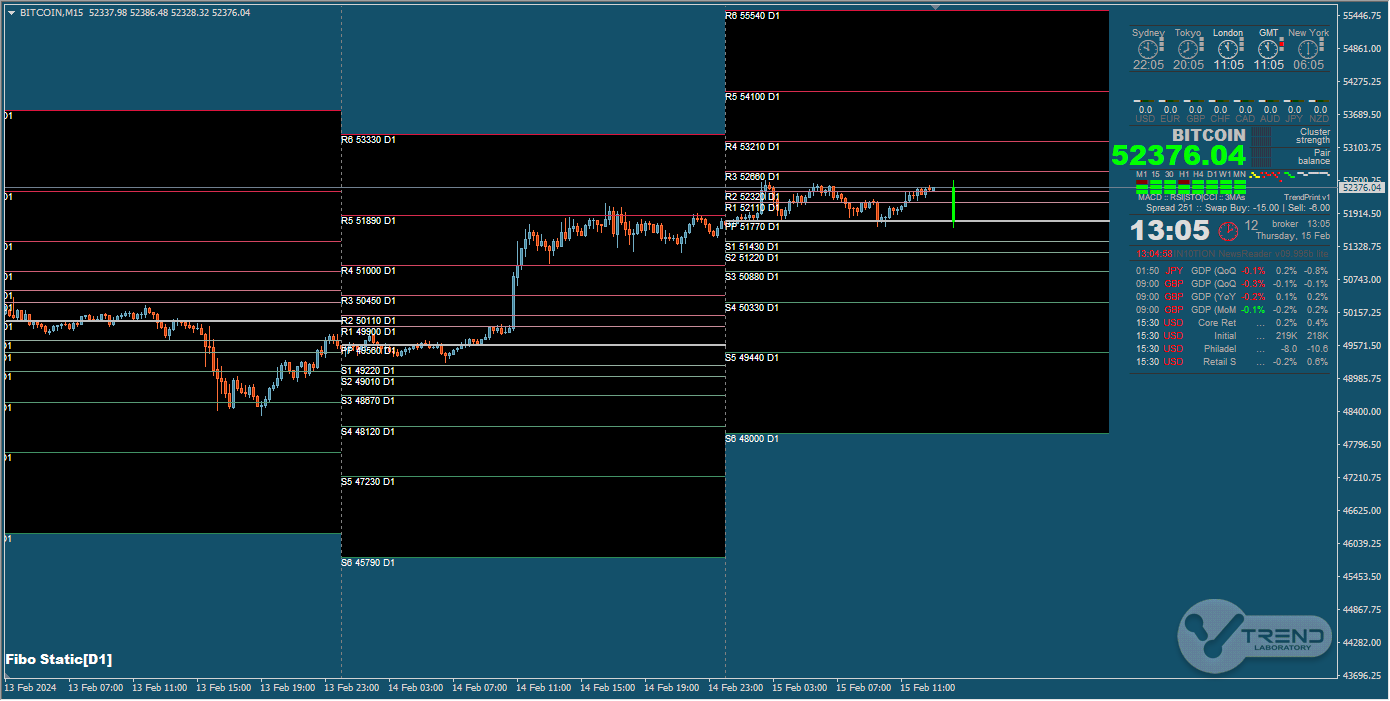

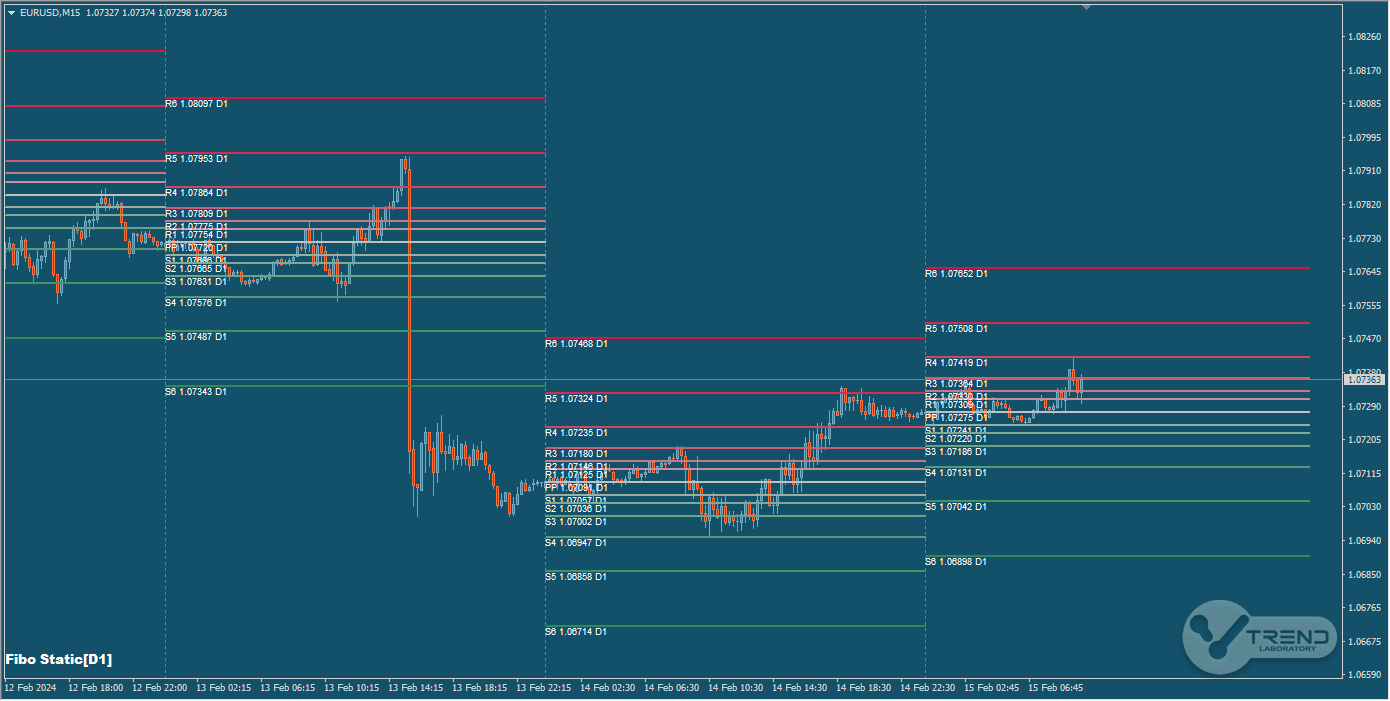

Wilder(or Floor) Points

There are many different ways to build Pivot Points, but the most famous are the Wilder(or Floor) Points, which he first described in his book New Concepts in Technical Trading Systems(1978).

Over time, the level names began to look different compared to the original ones. Thus, now they are named and calculated like this:

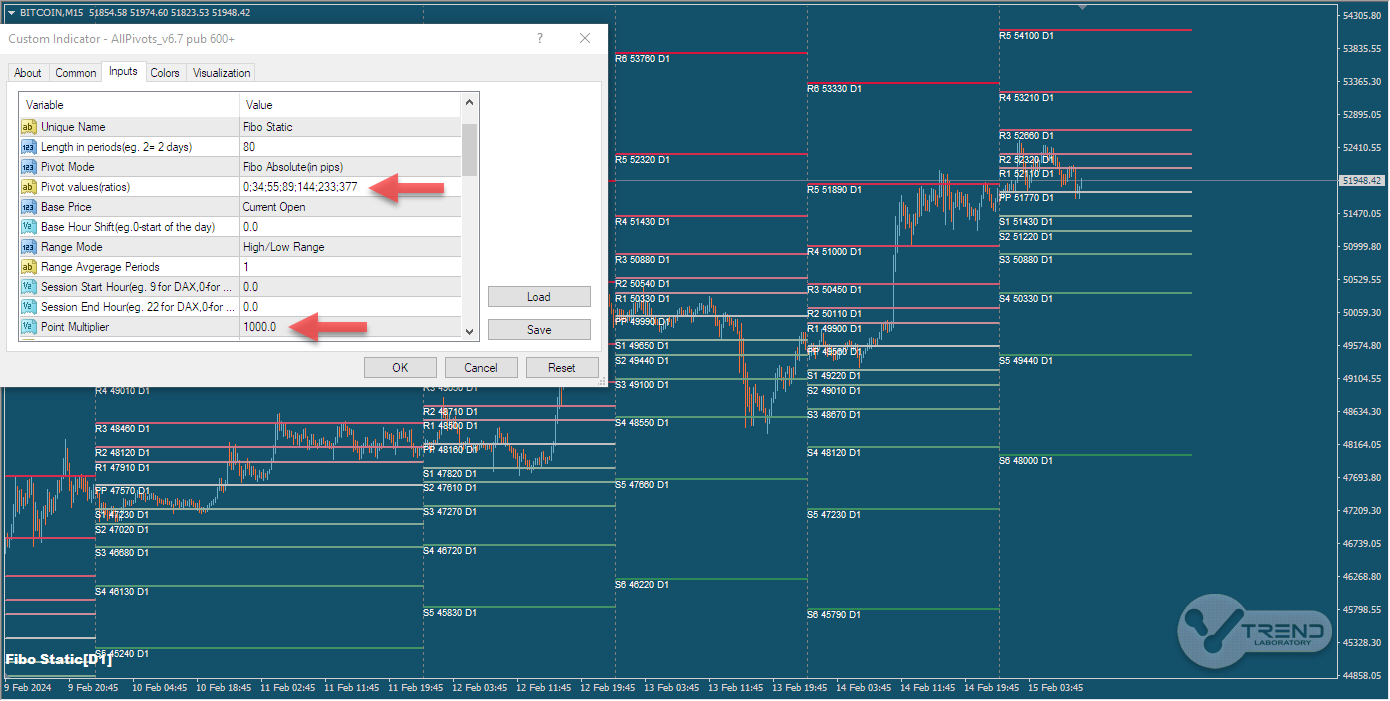

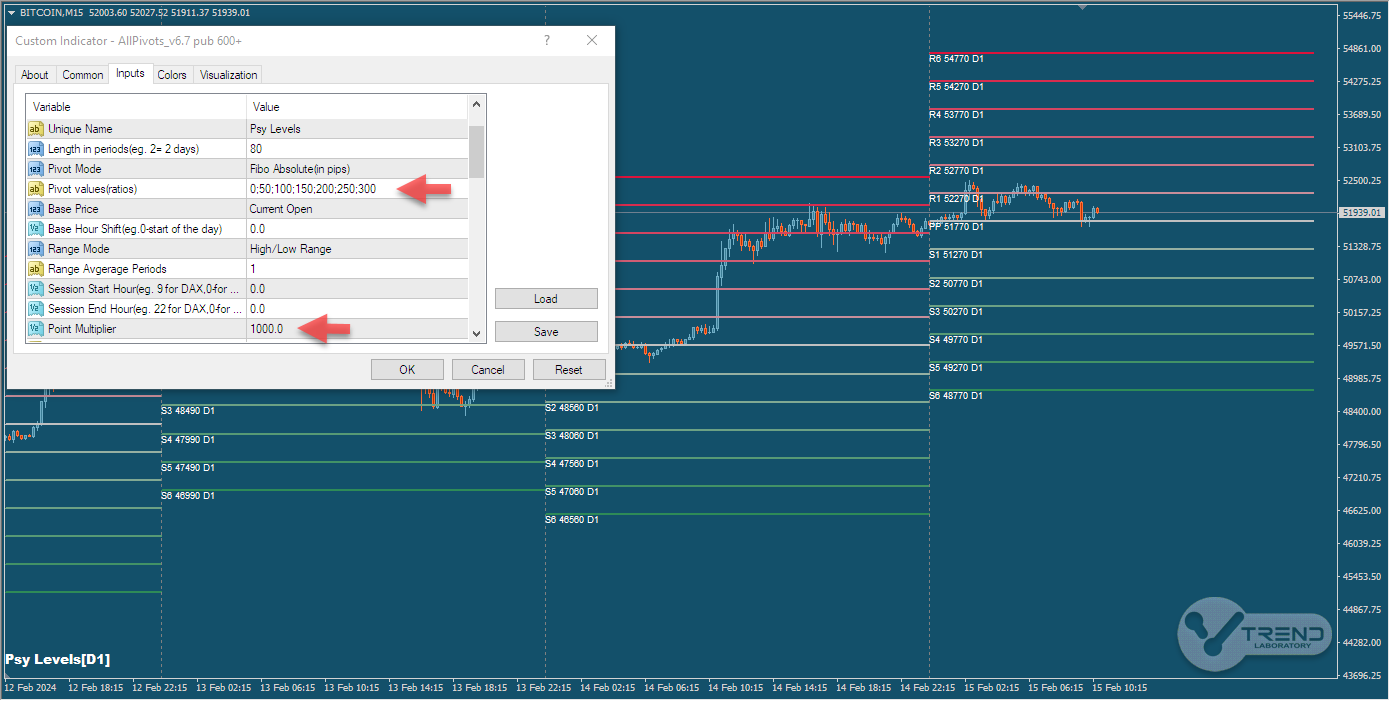

Relatively recently, I discovered a formula that allows to calculate any number of R & S points. This formula is implemented in the AllPivots indicator.

The Floor Trader Pivots for Tradestation you can find here.

There are many different ways to build Pivot Points, but the most famous are the Wilder(or Floor) Points, which he first described in his book New Concepts in Technical Trading Systems(1978).

Over time, the level names began to look different compared to the original ones. Thus, now they are named and calculated like this:

- Pivot point P= (High+Low+Close)/3

- Resistance 1 R1=(P×2)−Low

- Resistance 2 R2=P+(High−Low)

- Support 1 S1=(P×2)−High

- Support 2 S2=P−(High−Low)

Relatively recently, I discovered a formula that allows to calculate any number of R & S points. This formula is implemented in the AllPivots indicator.

The Floor Trader Pivots for Tradestation you can find here.